The UCLA Affordability Initiative is a campuswide effort on two fronts:

-

We want to help prospective students and their families better understand the total cost of higher education.

- We seek to make a UCLA undergraduate degree more affordable by fundraising for scholarships designed to eliminate the burden of student loans.

As a public institution serving the people of California, UCLA is aligned with the University of California commitment to provide pathways to debt-free education by 2030 and ensure a high-quality undergraduate education is more affordable for students, especially those from our state.

UCLA announced the initiative in April 2023 in tandem with its lead gift, a commitment of $15 million by UCLA alumnus Peter Merlone for undergraduate scholarships for California students.

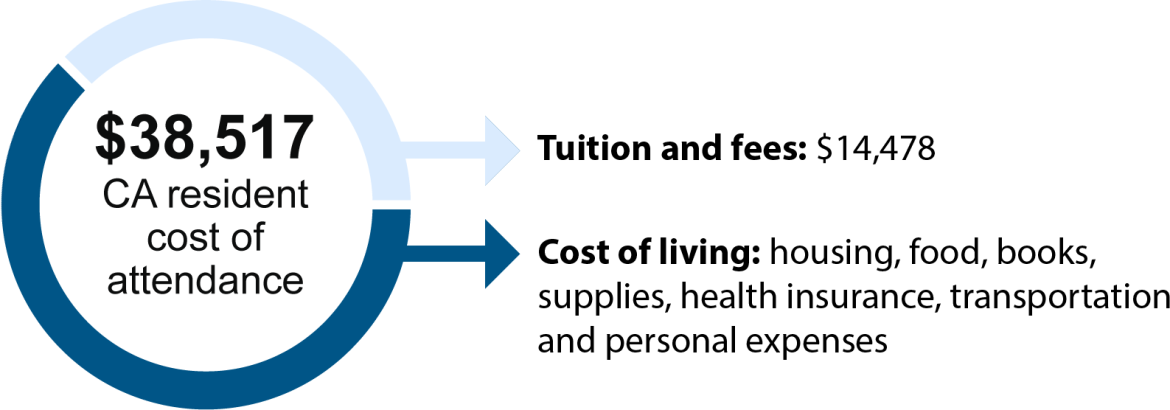

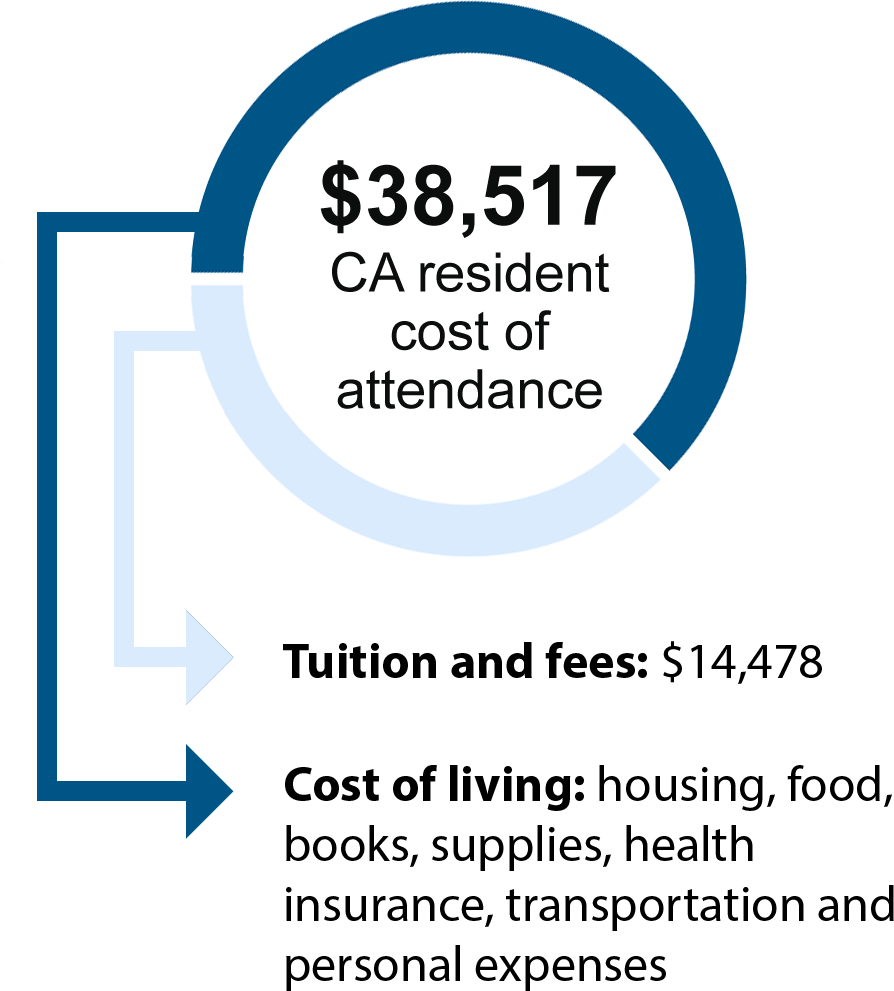

Understanding the Total Cost of Education

When students and families focus narrowly on the price of tuition, they overlook the total cost of education ― the sum of tuition plus the cost of housing, food, books, supplies, health insurance, transportation and personal expenses. It is this figure that presents the true challenge.

Total Cost of Education, 2023-24*

ONE YEAR AT UCLA

While UCLA’s tuition is significantly lower than that of many private universities, the cost of living continues to rise.

* Estimated.

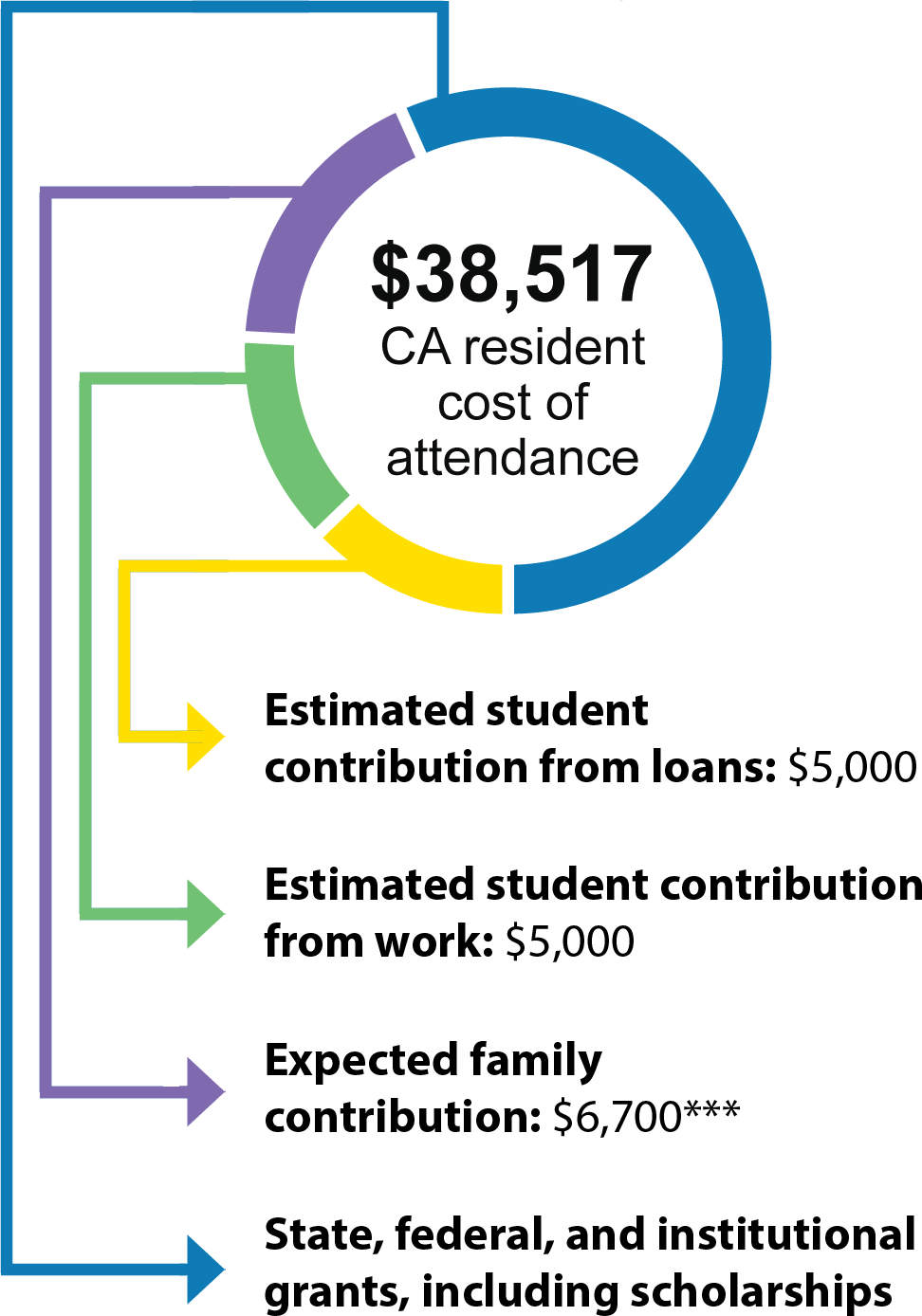

For students who receive financial aid, financing a college education can include student contributions from loans and work, family contributions, and grants and scholarships.

Covering the Total Cost of Education, 2023–24*

ONE YEAR AT UCLA

(Assumes CA median annual household income of $84,000**)

Financing a college education is a partnership that can include contributions from students, parents/families, and state, federal, and institutional grants, including scholarships.

* Estimated.

** Household income sourced from the U.S. Census Bureau.

*** Determined by Free Application for Federal Student Aid (FAFSA). Assumes a family of four with one child in college.

The initial financial goal of the UCLA Affordability Initiative is to leverage donor-funded scholarships to limit, and in some cases eliminate, student loan borrowing. For most students, that would require an additional scholarship of $5,000 annually.

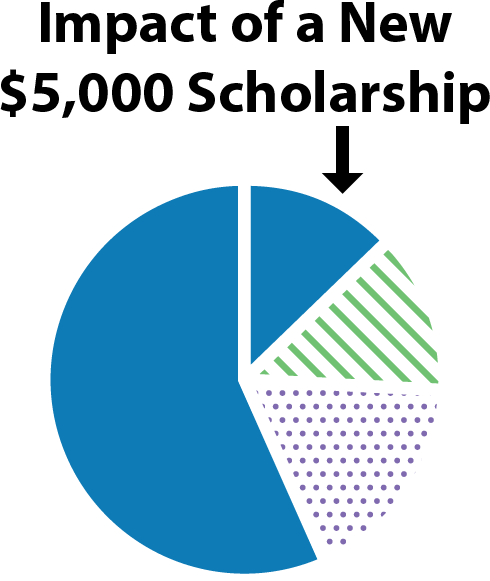

The Difference a New $5,000 Scholarship Makes

ONE YEAR AT UCLA

(Assumes CA median annual household income of $84,000*)

* Household income sourced from the U.S. Census Bureau.

Frequently Asked Questions

Why is UCLA launching the UCLA Affordability Initiative?

Volatility in the U.S. and global economies, the high cost of housing in Southern California, ongoing impacts of the COVID-19 pandemic, and other factors are creating a college affordability challenge for students and their families.

UCLA graduates go on to become our innovators, leaders and change-makers of tomorrow, improving life for everyone. It is in the best interest of California and its people for UCLA to provide scholarships to help pay for the entire cost of higher education so that we can retain promising people by educating them here at home.

Why is the UCLA Affordability Initiative initially focused on reducing or eliminating student loans?

Student loans postpone some of the financial burden of college. However, students who graduate with loans often make the decision to postpone or entirely forgo graduate education. They also make career choices defined by the need to repay their debt.

There is also an equity element to consider when evaluating the effectiveness of student loans as a college financing strategy. Young women and people of color are the groups most likely to take on student loan debt and to carry higher amounts of debt; due to wage disparities, they also pay down their debt more slowly. Student debt has even been shown to play a role in the ability of people of color to achieve home ownership.

Ideally, every UCLA student will have access to the same Bruin experience, one that is fully focused on making the most of everything UCLA has to offer, and that sets them up for their brightest, most limitless future.

Do I need to apply for a UCLA Affordability Initiative scholarship?

Prospective, incoming and continuing students can find instructions to apply for financial aid and to apply for scholarships on the UCLA Financial Aid & Scholarships website.